Interest rate cuts and credit ratings upgrade --[Reported by Umva mag]

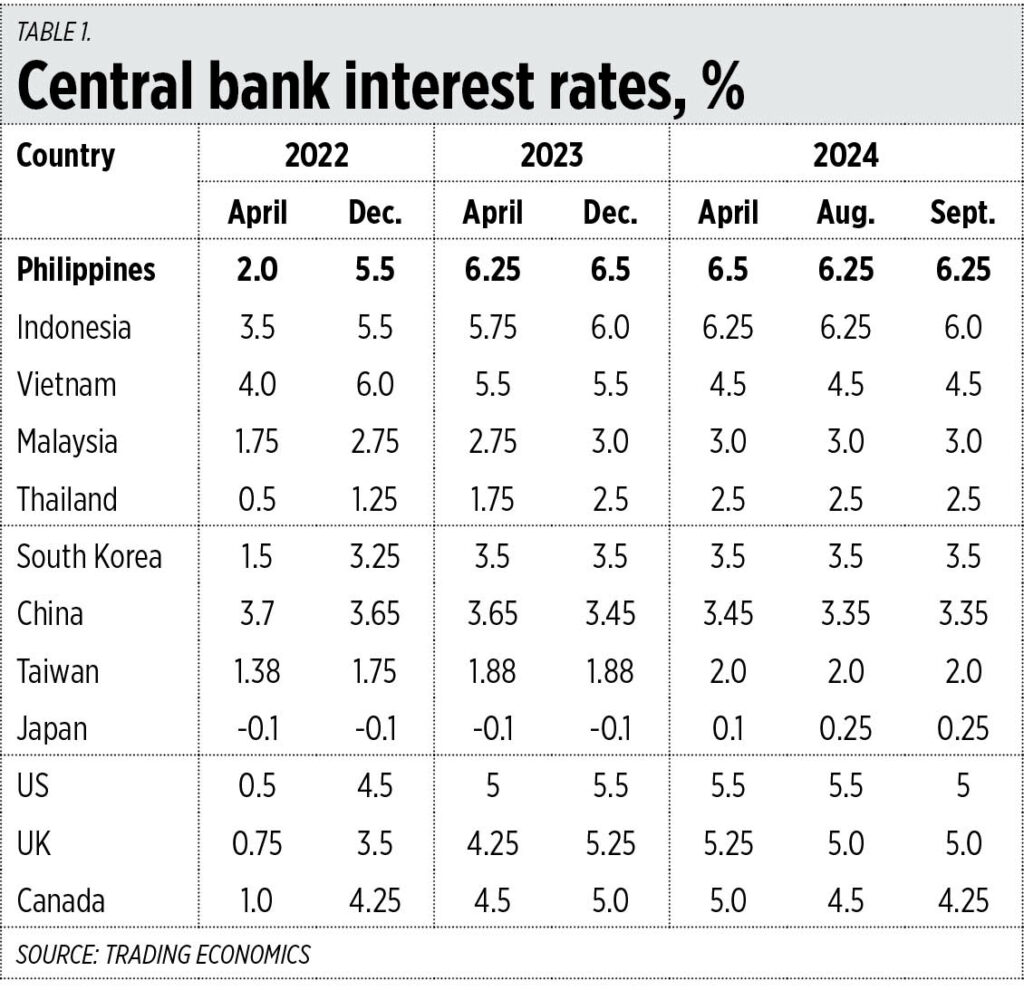

Among the important events that happened over the last few weeks was the big interest rate cuts in the US and Canada, with the Philippines, Indonesia and few other countries following with smaller interest rate cuts. In Asia, the Philippines had, until the second quarter this year, the highest interest rate set by monetary authorities […]

![Interest rate cuts and credit ratings upgrade --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_870x_66f194313a66e.jpg)

Among the important events that happened over the last few weeks was the big interest rate cuts in the US and Canada, with the Philippines, Indonesia and few other countries following with smaller interest rate cuts.

In Asia, the Philippines had, until the second quarter this year, the highest interest rate set by monetary authorities or central banks at 6.5%. Despite this policy, which was supposedly to control high inflation, the Philippines endured the highest inflation rate in the ASEAN-6 in 2023 at 6%, and the second highest in the region from January to July 2024 at 3.7%, next to Vietnam’s 4.1%.

So it was good that the Bangko Sentral ng Pilipinas (BSP) finally realized that its high interest rate policy should be reversed even if at a piecemeal rate.

Meanwhile, Japan raised its interest rate from -0.1% to 0.25% (see Table 1).

I bumped into the president of Meralco PowerGen Corp. (MGen), also the former president of Aboitiz Power Corp., Manny Rubio. He has a bright finance mind because two big conglomerates have trusted him. I asked Manny about the huge recent US Fed rate cut and its microeconomic impact to households, he replied that “Broadly it signals that the government is less worried now about controlling inflation and is now prepared to shift to an expansionary policy. For companies with substantial funding requirements to support their capex plans and new projects, this would mean a substantial reduction in their funding costs. Such savings would allow energy companies to complete new generation capacities and distribution facilities more cheaply which would eventually reduce the cost of electricity for the consumers.”

In a Viber message, Budget Secretary Amenah F. Pangandaman welcomed the interest rate cuts of the US Fed and BSP, saying, “this will have significant reduction in our interest payment which is now a significant share of our total annual budget. And this will eventually lead to efficient budget allocation to sectors that need more funding and help expand our economy.”

Secretary Pangandaman’s concern is correct because the amount of our interest payments has been rising fast, from P361 billion in 2019 to P429 billion in 2021, P503 billion in 2022, P628 billion in 2023, and P457 billion already in January-July 2024 alone. If this trend continues, then the full year 2024 interest payment will rise to P783 billion. Or a doubling of our interest payment in just five years from 2019 to 2024.

ROADMAP TO CREDIT RATINGS

There were a number of recent pieces in BusinessWorld on the subject of credit ratings: “Recto says Philippines still on track to achieve ‘A’ credit rating” (June 10), “Philippines needs 6-7% growth to achieve ‘A’ credit rating — Recto” (Aug. 14), “R&I upgrades PHL credit rating to ‘A-’” (Aug. 15), “Public-finance roadmap to help elevate PHL to ‘A’ credit rating — Budget dep’t” (Sept. 17), “Philippine credit rating upgrade possible if GDP grows faster than expected” (Sept. 18). There was also yesterday’s column, Introspective, entitled “Philippine sovereign credit rating: An ‘A’ rating, how soon?” (Sept. 23) by Alex Escucha.

My column has also discussed this subject previously: “Declining borrowings and improving credit ratings” (June 18), “Fast growth towards better credit ratings” (Aug. 13), “MUP pension reform and ‘A’ credit ratings” (Aug. 20).

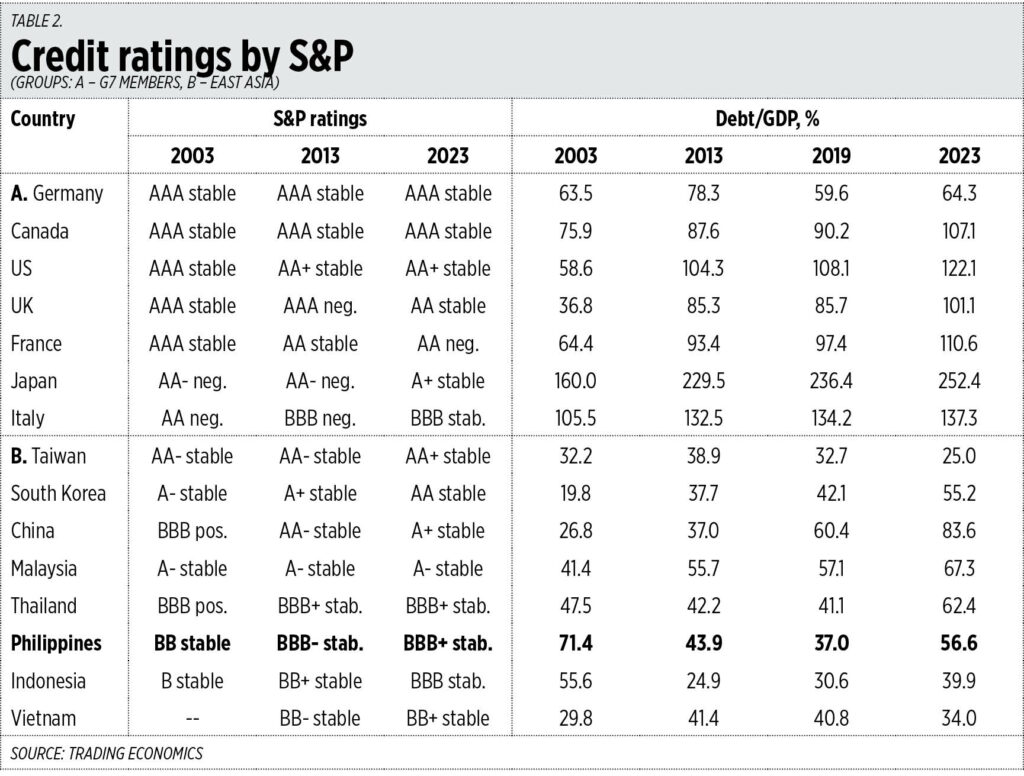

Finance Secretary Ralph G. Recto and Budget Secretary Pangandaman’s desire for the Philippines to attain a credit rating of “A” is understandable. An “A” means our capacity to service our loan obligations is high, so the cost of borrowing, both public and corporate, will be lower. And financing important projects like infrastructure will entail lower costs.

Currently, the Philippines has credit rating of BBB+ “stable” under S&P, Baa2 “stable” under Moody’s, and BBB “stable” under Fitch. Then there are the ratings of BBB+ “positive” from R&I, and A- “stable” from the Japan Credit Rating Agency (JCR). An A- from the JCR is good but it is the Big Three — S&P, Moody’s, and Fitch — that matter most.

One thing I notice though is that high credit ratings can also lead to the problem of a “moral hazard” in economics. Since the cost of borrowing is low due to high ratings, there is a tendency by governments to over-spend and over-borrow. So, the high ratings do not lead to less public debt and lower Debt/GDP ratios, the reverse can happen. This is happening in the G7 industrial countries and other countries around the world.

For example, there is Canada which has had a high AAA “stable” rating for decades and its Debt/GDP ratio kept rising, from 76% in 2003 to 107% in 2023. The US, the UK, France, Japan, and Italy all suffered declines in ratings over the past two decades but still at high A levels, except Italy (see Table 2).

An upgrade in ratings to “A” is important. But more important is how we can control our spending, deficit, and borrowings in years where there are no economic or finance crises, like 2022 to the present. We should have a budget surplus, not a deficit; we should reduce, not increase, our public debt stock; and we should reduce, not maintain, our Debt/GDP ratio.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

The following news has been carefully analyzed, curated, and compiled by Umva Mag from a diverse range of people, sources, and reputable platforms. Our editorial team strives to ensure the accuracy and reliability of the information we provide. By combining insights from multiple perspectives, we aim to offer a well-rounded and comprehensive understanding of the events and stories that shape our world. Umva Mag values transparency, accountability, and journalistic integrity, ensuring that each piece of content is delivered with the utmost professionalism.

![Pilot killed in mid-air collision with other small plane near Los Angeles --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1cba2a9562.jpg)

![Woman, 40 and eight-year-old girl found dead inside house in Salford as cops launch probe --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1ca3dbe39b.jpg)

![I nailed Levi Bellfield, now I’ll prove a serial killer is behind the unsolved West End Bunny Girl Murders --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1ca396c0e3.jpg)

![Incredible moment missing girl, 10, is found curled up in woods after frantic 24hr search using thermal-imaging drone --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1ca1c021a0.jpg)

![Nanny awarded $2.8M after rich boss secretly filmed her --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1ba9491177.jpg)

![Second sex assault allegation levelled at York Region message therapist --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1ba8f3e43c.jpg)

![Federal judge orders Trump assassination attempt suspect Routh not to be released --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1b77a3ece3.jpg)

![Pro-Evo Morales protests in Bolivia saw violent clashes --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f19211a18fd.jpg)

![Brazil has world’s worst air quality this week, holds 75% of all wildfires burning in South America --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f17a206e5d4.jpg)

![Brazil’s Tupinambá Indigenous people reunite with sacred cloak after 380 years --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f17a19c6890.jpg)

![New insider traveler guide follows spike in tourism to Argentina --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f17a11a5429.jpg)

![Greggs meets its match as hundreds oppose plans to open new store in town centre --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c732f077a.jpg)

![Where is Joe O’Reilly now? --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1b622d8ab2.jpg)

![Russia Jails U.S. Citizen on Kidnapping Charge --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c6b934b87.jpg)

![New Kazakhstan, old methods: Civil society laments stalled political reforms --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c33371bd0.jpg)

![Russians Denying Medical Care to Ukraine Prisoners – UN Experts --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1bca00611c.jpg)

![Russian drone strike destroys Ukrainian armored vehicle – MOD (VIDEO) --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1b99f099f8.jpg)

![OPEC daily basket price stood at $74,74 per barrel Friday --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1a6dc9557d.jpg)

![Egyptian warship offloads more arms to Somalia, officials say --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1a4b4765ea.jpg)

![At least 30 bodies found on boat along migrant route off Senegal --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f19aa05a34b.jpg)

![UK-based firm opens new cargo facility at Maputo airport --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f192abb93cf.jpg)

![Enigmatic voter group could split ticket for Trump, Dem Senate candidate in Arizona --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1cb3d2ff20.jpg)

![Cruz race now a 'tossup' should be warning for Texas GOP, says expert --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1cb3aa4cbd.jpg)

![BREAKING: Would-Be Trump Assassin Ryan Routh Possessed List That Included Dates From August to October Where Trump Appeared or Was Expected to Be --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c42f46eef.jpg)

![Chris Cuomo Fact-Checks AOC Over Israeli Pager Attack-‘She’s Dead Wrong’ (Video) --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c42c8b2c3.jpg)

![DEMS GONE WILD: Married Kentucky Democrat Lawmaker In Hot Water for Reportedly Groping Strippers While Drunk and Offering Thousands for Sex with Another at Strip Club --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c4299c5e0.jpg)

![Nasal spray flu vaccine gets FDA approval for home use: ‘A good alternative’ --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1cb4252bba.jpg)

![Mum, 28, told ‘you’re too young for cancer’ inspires devastating Hollyoaks storyline after ‘piles’ misdiagnosed --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1cafcc578e.jpg)

![The 9 things your EYES can reveal about your health – from killer aneurysms to cancer and stroke --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1caeb1572b.jpg)

![Woman, 34, who put ‘dry cough’ down to flu is diagnosed with one-in-a-million disease that kills half its victims --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1988cda371.jpg)

![Men’s brains SHRINK by 8pm everyday – before resetting overnight, scientists discover --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f198876244e.jpg)

![Never seen before player set to feature for Aston Villa in Carabao Cup tie against Wycombe --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c243dfa20.jpg)

![Newcastle reach agreement to sign 37-year-old --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c240b3472.jpg)

![Newcastle handed Sandro Tonali blow as they prepare for Man City showdown --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c23e2cf4e.jpg)

![Raiders' Antonio Pierce questions team's effort in loss to Panthers --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c14ea4bbe.jpg)

![Super Bowl champ suggests Travis Kelce not completely focused on football after latest quiet game --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c14da81dd.jpg)

![BlockDAG’s $1 Price Prediction Bolstered by Rumored Premier League Deal—Plus Updates on INJ Price & Aave Founder’s Strategy --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c9a0164a7.jpg)

![Which is the best Starter Pack in EA FC 25 Ultimate Team? --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c99eea5f8.jpg)

![EA FC 25 duplicate storage explained (SBC Storage) --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c99dbef01.jpg)

![UAE to push for AI cooperation in meeting with President Biden --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c99b520cd.jpg)

![Fast-Growing Layer 2 ICO Pepe Unchained Hits $14.8M Mark: Next Big Meme Coin? --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c997af786.jpg)

![Lizzie Cundy looks ageless as she shows off her legs after glam makeover --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1cab615a1d.jpg)

![Pete Wicks shocks Strictly It Takes Two host with comment about pro partner Jowita Przystał as they fuel romance rumours --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1ca90f33e1.jpg)

![MAFS UK star reveals he’s already returned to his day job after sparking rumours he’s split from new bride --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1ca8edf5c3.jpg)

![Coronation Street’s Sarah Platt left devastated as Bethany is rushed into intensive care with sepsis --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1ca8cef6b7.jpg)

![Inside rise of blind Strictly star Chris McCausland from how he nearly became a real life Bond to ‘winging’ training --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1ca88694fa.jpg)

![Liam Gallagher hits back at Oasis fans who slammed his Wembley performance AGAIN saying they’re ‘not going to stop him’ --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c0a52c40a.jpg)

![Pregnant Charlotte Crosby shows off her growing baby bump as she strips down to her bikini for hot tub dip --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c0a25aab9.jpg)

![Robbie Williams turns down big money deal for Las Vegas residency in 2025 as he waits for better offer --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1b68d6ef3f.jpg)

![No more Blade helicopter rides: JetBlue scraps unique Mosaic elite status perk --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c8dd0f09e.jpg)

![5 under-the-radar ways to maximize the Amex Gold’s dining credits --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1beba906fa.jpg)

![The 15 best places in the world to see fall foliage without the crowds --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1b4a4a9b75.jpg)

![CALPAK vs. Samsonite: Which is Better? --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1aab026e17.jpg)

![They tore up the sidewalk and then disappeared. Parkdale residents and businesses now want answers --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1bacf8ac1d.jpg)

![Don’t sleep on this unmissable £8.99 Aldi Specialbuys deal --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f18af3a6973.jpg)

![UK state school where kids learn yoga and meditation named as one of world’s best --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f18af2c22f4.jpg)

![Latest money news: Free breakfasts for thousands of kids are coming --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f180dd01e9e.jpg)

![Thousands of households urged to check if £50 cost of living payment has landed in bank accounts today --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1cac7794ef.jpg)

![Crypto Miner Truce Leaves Open the Possibility of Riot Taking Over Bitfarms --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c6425ef57.jpg)

![Second jumbo rate cut possible to guard ‘sweet spot’ on jobs, inflation, Fed officials signal --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1c63c427e4.jpg)

![Constellation CEO Says US Should Copy China to Meet AI Power Use --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1bc305a379.jpg)

![How Veterans Are Using Social Media to Win in Entrepreneurship --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1b885c0371.jpg)

![Huw Edwards used ‘mental health’ to try and defend actions…by doing so he lampoons those with life-affecting illnesses --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1ca7b03f7b.jpg)

![I went Halloween shopping at Five Below with a $50 budget and think the competition should be scared --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1b8936c2c9.jpg)

![Vinod Khosla says universal basic income may be needed as AI takes over jobs and drives wealth disparity --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1b8922952d.jpg)

![The RFK Jr.-Nuzzi relationship had reportedly become an open secret in some circles before the news broke --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1b88fe76ba.jpg)

![Earth is about to get a 2nd moon, for 57 days only. Here's what you need to know. --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1b88f514dd.jpg)

![GSIS lends P208B under MPL Loan Flex program --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1942cd1159.jpg)

![Social Commerce: Adapting to an Evolutionary Shift in Retail --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f1769d72a2c.jpg)

![Unilever to offer grants to groups addressing plastic pollution --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66f17de4aff54.jpg)

![How DEI became the latest battleground in the right’s ‘war on woke’ --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_140x98_66f163a8ea121.jpg)

![Microplastics found in the brain could be linked to rise in Alzheimer’s cases --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_140x98_66f15f192b24a.jpg)

![Soyuz MS-25 lands from ISS with NASA astronaut and record-setting cosmonauts (video) --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_140x98_66f1671cf334a.jpg)

![Sen. Tuberville: Biden and Harris must protect Trump as much as they can --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_140x98_66f1739047a10.jpg)

![#WalangPasok: Class Suspensions For September 18, 2024, Wednesday --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_140x98_66f165b529306.jpg)