Full list of companies who pay real living wage as millions set for pay rise --[Reported by Umva mag]

IN a cost-of-living crisis where all our bills increasing dramatically, millions of households don’t get paid enough to live comfortably. But the good news is that over 15,000 employers have signed up to the Real Living Wage. This means that they voluntarily pay all of their workers more than the legal minimum level. Read on to find out how the Real Living Wage is calculated The Real Living Wage, which is calculated based on the cost of a basket of household goods and services, is £12 an hour outside of London and £13.15 an hour in the Capital. It’s supposed to be higher than the legal requirement as it factors in that actual costs are higher than this. By contrast, the government-set National Minimum Wage, the minimum pay-per-hour for workers aged between 18 and 21, is currently £8.60 an hour. Workers who are under 18 only need to be paid £6.40 an hour, as do apprentices. Once a worker turns 21, they legally have to be paid the National Living wage, which is £11.54 an hour. But this is still £1,092 a year less than a worker on the real Living Wage would earn, and £3,334.5 less than a worker on the London salary would get. How is the Real Living Wage calculated The rates are calculated annually by think-tank The Resolution Foundation and overseen by the Living Wage Commission, based on the best available evidence about living standards in London and the UK. It uses a public consultation method called MIS to inform the rate. MIS asks groups to identify what people need to be able to afford as a minimum. This is fed into a calculation of what someone needs to earn as a full-time salary, which is then converted to an hourly rate. Living costs are much higher in London than in the rest of the UK , which is why the London Living Wage is higher than the UK rate. Rent is the primary living cost that causes the differential between the two rates but it also takes into account childcare, travel costs, food and household bills. Who pays the Real Living Wage The Real Living Wage is not a government-set wage rate, so businesses don’t have to pay it. Any companies that are paying it do so voluntarily. The Real Living Wage Foundation says that there are over 15,000 Living Wage employers, including half of the FTSE 100, and household names such as Lush, Aviva, Timpson, Ikea and Liverpool Football Club. There are also thousands of small businesses that choose to pay it. The list of companies in the FTSE 100 that pay it are: 3i Group Admiral Group PLC AstraZeneca Auto Trader Aviva BAE Systems Barratt Development Barclays Beazley BP Burberry Convatec Croda Diageo Experian Glencore GSK Haleon Hargreaves Lansdown HSBC Informa Intermediate Capital Group (ICG) Intertek Legal and General Lloyds Banking Group London Stock Exchange M&G National Grid NatWest Group Pearson Persimmon Reckitt RELX Group Rightmove Sage Schroders SEGRO Plc Severn Trent Smiths Smith and Nephew SSE Standard Chartered Taylor Wimpey Unilever Unite Group PLC United Utilities Vistry Group Vodafone WPP If you want to find out whether a specific employer is signed up to the wage scheme, you can find out easily by typing the company name into the Living Wage Foundation search tool. How the legal National Minimum Wage and Living Wages are changing The Labour government is making changes to the way the national minimum wage is set, in a move that could see millions get a pay rise. It’s first step was to overhaul the remit of the Low Pay Commission (LPC). The changes mean that for the first time, the independent body will take the cost of living into account when it makes future recommendations to government on the minimum wage. In the election, Labour also promised to remove the “discriminatory age bands to ensure every adult worker benefits”. However, in July, the Business and Trade Secretary and Deputy Prime Minister instructed the LPC to narrow the gap between the minimum wage rate for 18–20-year-olds and the National Living Wage. The government said that this will be the first step towards achieving a single adult rate. Finally, the government promised to work with the Single Enforcement Body and HMRC and ensure they have the powers to ensure a genuine living wage is properly enforced, including penalties for non-compliance. So far, steps around this have not been announced. Chancellor Rachel Reeves said: “Economic growth is our first mission, and we will do everything we can to ensure good jobs for working people. But for too long, too many people are out of work or not earning enough. “The new LPC remit is an important first step in getting people into work and keeping people in wo

![Full list of companies who pay real living wage as millions set for pay rise --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_870x_66efc845e0e5c.jpg)

IN a cost-of-living crisis where all our bills increasing dramatically, millions of households don’t get paid enough to live comfortably.

But the good news is that over 15,000 employers have signed up to the Real Living Wage.

This means that they voluntarily pay all of their workers more than the legal minimum level.

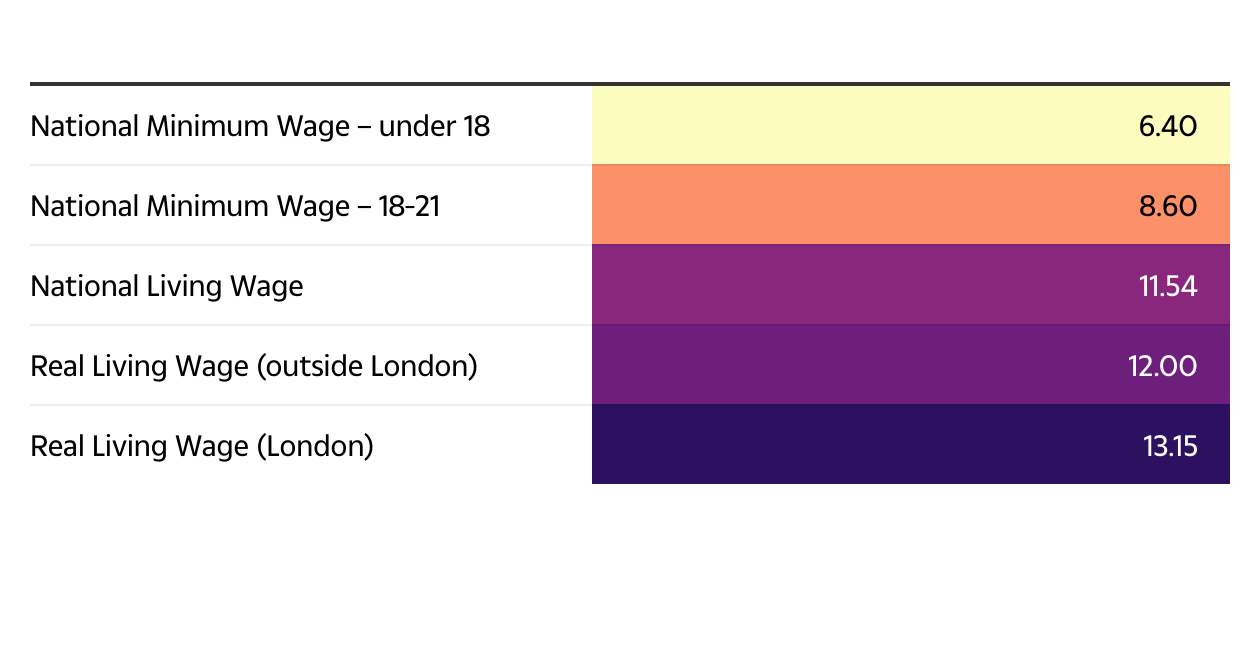

The Real Living Wage, which is calculated based on the cost of a basket of household goods and services, is £12 an hour outside of London and £13.15 an hour in the Capital.

It’s supposed to be higher than the legal requirement as it factors in that actual costs are higher than this.

By contrast, the government-set National Minimum Wage, the minimum pay-per-hour for workers aged between 18 and 21, is currently £8.60 an hour.

Workers who are under 18 only need to be paid £6.40 an hour, as do apprentices.

Once a worker turns 21, they legally have to be paid the National Living wage, which is £11.54 an hour.

But this is still £1,092 a year less than a worker on the real Living Wage would earn, and £3,334.5 less than a worker on the London salary would get.

How is the Real Living Wage calculated

The rates are calculated annually by think-tank The Resolution Foundation and overseen by the Living Wage Commission, based on the best available evidence about living standards in London and the UK.

It uses a public consultation method called MIS to inform the rate. MIS asks groups to identify what people need to be able to afford as a minimum.

This is fed into a calculation of what someone needs to earn as a full-time salary, which is then converted to an hourly rate.

Living costs are much higher in London than in the rest of the UK , which is why the London Living Wage is higher than the UK rate.

Rent is the primary living cost that causes the differential between the two rates but it also takes into account childcare, travel costs, food and household bills.

Who pays the Real Living Wage

The Real Living Wage is not a government-set wage rate, so businesses don’t have to pay it. Any companies that are paying it do so voluntarily.

The Real Living Wage Foundation says that there are over 15,000 Living Wage employers, including half of the FTSE 100, and household names such as Lush, Aviva, Timpson, Ikea and Liverpool Football Club.

There are also thousands of small businesses that choose to pay it.

The list of companies in the FTSE 100 that pay it are:

- 3i Group

- Admiral Group PLC

- AstraZeneca

- Auto Trader

- Aviva

- BAE Systems

- Barratt Development

- Barclays

- Beazley

- BP

- Burberry

- Convatec

- Croda

- Diageo

- Experian

- Glencore

- GSK

- Haleon

- Hargreaves Lansdown

- HSBC

- Informa

- Intermediate Capital Group (ICG)

- Intertek

- Legal and General

- Lloyds Banking Group

- London Stock Exchange

- M&G

- National Grid

- NatWest Group

- Pearson

- Persimmon

- Reckitt

- RELX Group

- Rightmove

- Sage

- Schroders

- SEGRO Plc

- Severn Trent

- Smiths

- Smith and Nephew

- SSE

- Standard Chartered

- Taylor Wimpey

- Unilever

- Unite Group PLC

- United Utilities

- Vistry Group

- Vodafone

- WPP

If you want to find out whether a specific employer is signed up to the wage scheme, you can find out easily by typing the company name into the Living Wage Foundation search tool.

How the legal National Minimum Wage and Living Wages are changing

The Labour government is making changes to the way the national minimum wage is set, in a move that could see millions get a pay rise.

It’s first step was to overhaul the remit of the Low Pay Commission (LPC).

The changes mean that for the first time, the independent body will take the cost of living into account when it makes future recommendations to government on the minimum wage.

In the election, Labour also promised to remove the “discriminatory age bands to ensure every adult worker benefits”.

However, in July, the Business and Trade Secretary and Deputy Prime Minister instructed the LPC to narrow the gap between the minimum wage rate for 18–20-year-olds and the National Living Wage.

The government said that this will be the first step towards achieving a single adult rate.

Finally, the government promised to work with the Single Enforcement Body and HMRC and ensure they have the powers to ensure a genuine living wage is properly enforced, including penalties for non-compliance. So far, steps around this have not been announced.

Chancellor Rachel Reeves said: “Economic growth is our first mission, and we will do everything we can to ensure good jobs for working people. But for too long, too many people are out of work or not earning enough.

“The new LPC remit is an important first step in getting people into work and keeping people in work, essential for growing our economy, rebuilding Britain and making everyone better off”.

When was the minimum wage introduced?

THE first National Minimum Wage was put in place in 1998 by the Labour government.

It originally applied to workers aged 22 and over, and there was a separate rate for those aged 18-21.

A separate rate for 16-17-year-olds was introduced in 2004, and in 2010, 21-year-olds became eligible for the adult rate of the National Minimum Wage.

The rate is set by the Government each year based on recommendations by the Low Pay Commission (LPC).

The following news has been carefully analyzed, curated, and compiled by Umva Mag from a diverse range of people, sources, and reputable platforms. Our editorial team strives to ensure the accuracy and reliability of the information we provide. By combining insights from multiple perspectives, we aim to offer a well-rounded and comprehensive understanding of the events and stories that shape our world. Umva Mag values transparency, accountability, and journalistic integrity, ensuring that each piece of content is delivered with the utmost professionalism.

![Hezbollah claims rocket attack at Israeli base near Haifa --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efe034c2b96.jpg)

![At least 50 killed in Iran coal mine blast: State media --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efe02f51907.jpg)

![Israel closes Al Jazeera bureau in Ramallah: All you need to know --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efe02b37111.jpg)

![Ukraine conflict damaging EU tourism --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efdfaabcd84.jpg)

![Alabama shooting leaves 4 dead, police say --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efde7fc947f.jpg)

![Popular vacation destinations on alert after hazardous materials wash ashore --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd346898aa.jpg)

![Trump gaining in surprise new stronghold as crime, migrants shift blue voters right --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd3440e868.jpg)

![Four dead and ‘dozens’ injured after mass shooting in Alabama --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efceca4c09b.jpg)

![Dolphins dying in Amazon lake made shallow by drought --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efcb0e4e5bd.jpg)

![Peru’s Olympic medal winner Stefano Peschiera on never losing faith (Interview) --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef6820d0626.jpg)

![UN chief speaks to Venezuela’s Maduro about alleged human rights violations --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ee49b6321bd.jpg)

![X names Brazil legal representative, its lawyers say --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ee2d98a648b.jpg)

![Neighbours evacuated as lightning strikes house during heavy rain storms --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd8dd57338.jpg)

![Meet the key ministers shaping France's new government --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd8a63dd5f.jpg)

![Paralympics legacy spurs push for inclusive sports in Paris --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efce9b83b29.jpg)

![UK weather: Urgent travel warning with 4 INCHES of rain to hit, says Met Office as summer officially comes to an end --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efc7c5aa7c2.jpg)

![Moscow weighs in on new Ukraine ‘peace summit’ --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efdf70b9bce.jpg)

![At least 51 dead in Iran coal mine blast --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efdefe15770.jpg)

![Russia won’t go to second Ukraine ‘peace summit’ – Moscow --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd563682c9.jpg)

![EU report shows Ukraine conflict damaging bloc’s tourism --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd5614cc5a.jpg)

![Kenyan church cult massacre that killed hundreds haunts survivors --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efca8ca6e57.jpg)

![Fortified bouillon cubes are seen as way to curb malnutrition in Africa --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efc08d44e32.jpg)

![Chad floods kill 503, affect 1.7 million people, UN says --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef66b789061.jpg)

![Ethiopia’s Amhara: Surge in IDPs worries UN --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef40852a727.jpg)

![Working class will come home to Harris, rallygoers in postindustrial Pennsylvania say --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd2c615f04.jpg)

!['Pretty damn significant': Slotkin suffers blow in Michigan as farm bureau jilts Dems to endorse GOP candidate --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd2c1e28ab.jpg)

![NO ONE ELECTED HER: Why Does Jill Biden’s Signature Appear on Joe Biden’s Official Legislation Folders? --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef90021207d.jpg)

![Jewish Democrat From Pennsylvania on Supporting Trump: ‘If You’re a Jew, if You Support Israel, There’s Only One Candidate Here: Donald J. Trump’ (VIDEO) --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef8ffb0a1fc.jpg)

![Tim Walz Accidentally Creates New Ad for the Trump Campaign: ‘We Can’t Afford Four More Years of This!’ (VIDEO) --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef85ee3301c.jpg)

![Virus linked to rare paralyzing illness in children could spike in US, wastewater data suggests --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efdce30d472.jpg)

![‘Super fit’ woman, 24, left fighting for life after ‘harmless’ UTI spread uncontrollably through her body --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd2871f062.jpg)

![From sea moss supplements to ‘all in one’ eye drop – we test eye care products --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef3c4f4ddf6.jpg)

![Extra iron to boost energy, zinc to fight infections & other supplements that will give your health a boost this autumn --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef323f82c1b.jpg)

![NHS crisis deepens as it treats fewer people per medic than before pandemic despite more funding AND staff --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef323d83aaa.jpg)

![Chelsea still in talks over striker transfer despite Nicolas Jackson form, four big names being considered --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efde09da2cf.jpg)

![Exclusive: Tottenham, Aston Villa & Nottingham Forest among transfer suitors for Turkish stars --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efde067d3d1.jpg)

![Liverpool progressing with important new contract for star player --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efc9e77420b.jpg)

![Eddie Hearn reveals chances of Anthony Joshua and Tyson Fury fight after Daniel Dubois loss --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efc4f68f9d2.jpg)

![Arsenal expected to re-explore transfer move for summer target ahead of January --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efbfc6572eb.jpg)

![Will $SATO Reach $1? Pepe Unchained Surges to $14.5M in Presale as Atsuko Sato Price Rallies --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efdb37e9af1.jpg)

![Stake, Vote, and Earn: The FLOCKERZ Meme Coin Explained --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efdb356e267.jpg)

![Deals: the new Apple iPhone 16 models are now available --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd6fe5d58f.jpg)

![Nasa’s terrifying list of asteroids that could wipe out life on Earth – the worst is like dropping 75bn tonnes of TNT --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efc87b714be.jpg)

![Weekly poll results: it's a bad start for the iPhone 16 series as people look for alternatives --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efaf28b8aa2.jpg)

![Netflix to axe over 60 movies and TV shows next month – including comedy trilogy and iconic rom-com --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efdc31d1393.jpg)

![Zoe Ball’s return to BBC Radio 2 officially confirmed by bosses after weeks off air --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efdc2ec9f49.jpg)

![Matt LeBlanc’s Friends co-stars worried about his ‘dishevelled’ appearance after Matthew Perry’s death --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd95cc479a.jpg)

![Apples Never Fall star Sam Neill’s comments about ‘grim’ cancer treatment after concern from fans --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd95aaaf70.jpg)

![Strictly Come Dancing fans spot the exact moment Pete Wicks is left fuming at his dismal show score --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd21d59f64.jpg)

![Ashley Cain ‘isn’t scared of death’ ahead of terrifying 3,000 mile world record attempt dodging sharks and killer whales --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efc80d07fb7.jpg)

![Eagle-eyed Strictly viewers convinced bosses purposely cutaway from Zara McDermott after her bombshell ballroom return --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd24ee7205.jpg)

![BGT winner Sydnie Christmas has ‘no idea’ what she’ll perform at the Royal Variety – and fears rule-break with the King --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efc83a562fa.jpg)

![‘I’ll never get over it’ says Molly Mae as she shares emotional message to fans after launch of Maebe fashion brand --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efbe5fc1df5.jpg)

![Brit model Rebecca Donaldson stuns in racy red bikini for beach shoot --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef5a4bea6dd.jpg)

![Travel in time to 5 destinations that salute battles and war heroes right here at home --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd305008c2.jpg)

![Celeb-loved English hotel on its own island that you can only visit at certain times of day --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efc84a03354.jpg)

![Top Sites to Visit Belem: Historic Adventures in Portugal --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef6cd542840.jpg)

![Stunning seaside city with the world’s most beautiful bookshop and very famous 80p treats --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef463de454d.jpg)

![Man buys house on Amazon for £20,500 --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efcf4315c5f.jpg)

![We headed to the ultimate backpacking destination for our luxury honeymoon --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efcf417767a.jpg)

![Five things you must do now to save on energy bills as temperatures plummet --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efc542af619.jpg)

![These new affordable leggings smooth the hips and sculpt the bum (and they’re now 20% off) --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efbb9203f03.jpg)

![Legendary department store confirms ANOTHER closure as shoppers warn ‘there’s going to be nothing left’ --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efdc6374e99.jpg)

![E-Commerce Hacks: 6 Proven Ways to Make Your Online Business Thrive --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd801c6a9e.jpg)

![Sri Lanka to Hold Run-Off Vote Count as No Candidate Gets 50% --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd7fee6517.jpg)

![Millions on six benefits eligible for £300 winter fuel payment to get extra DWP bonus in December --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efd254b3a3d.jpg)

![Full list of companies who pay real living wage as millions set for pay rise --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efc846365ac.jpg)

![Elon Musk has to be picky about where he fights for free speech, corporate law expert says --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66efac59128e2.jpg)

![JD Vance suggested the US's support for NATO could be pulled if Europe tries to regulate Elon Musk's X as free speech debate rumbles on --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef705b88c51.jpg)

![As a financial planner, I always say you don't have to buy real estate to build wealth — a better strategy is much easier --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef5c36cd66a.jpg)

![Apple iPhones aren't coming with AI software. Here's why it doesn't matter. --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef5c321bd59.jpg)

![Labour should be cock-a-hoop as they head to conference so why are Keir Starmer & Rachel Reeves so gloomy? --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ef3bde71fcd.jpg)

![I thought my mum was over Pension Credit limit and would miss out Winter Fuel Payment – Martin Lewis tip made me check --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ec6c40b8890.jpg)

![UK employers losing focus on inclusive hiring, says new report --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ec81dedff6e.jpg)

![Rwanda’s economic resilience shines despite challenges --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_430x256_66ec71fcc7fc9.jpg)

![Mexican president says US shares blame for Sinaloa drug cartel violence --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_140x98_66ece1fa5df0b.jpg)

![Attempted prison escape in Honduras leaves 2 inmates dead and 3 injured --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_140x98_66ecbb1be9b84.jpg)

![Boeing flight from the US diverts to Gatwick after declaring emergency --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_140x98_66ed2c404d9e2.jpg)

![Russia’s Sovcomflot Says G-7 Sanctions Make Oil Trade Less Safe --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_140x98_66ed901ab4f50.jpg)

![How to clean up your Gmail inbox --[Reported by Umva mag]](https://umva.us/uploads/images/202409/image_140x98_66eed7862d7b5.jpg)